Lantzman Lending’s Market Update for Investors: March 2024 Case-Shiller Index Soars to New Heights

Hey there, real estate aficionados! The latest S&P CoreLogic Case-Shiller Index for March 2024 is out, and it’s full of insights that every savvy investor should know. Let’s dive into the numbers and see what they mean for the housing market and your investment strategies.

A Record-Breaking Month

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index hit a new all-time high in March 2024. Yes, you heard that right! This index, which measures home prices across all nine U.S. census divisions, reported a 6.5% annual gain. It’s the same robust increase we saw in February, signaling sustained momentum in the housing market. This is now the 9th consecutive month where we have seen appreciation annually. Home prices appear to be immune to the effects of higher rates, as inventory remains suppressed in many major markets. Inventory has been shrinking since the post mortgage melton more than 10 years ago due to various reasons, and that has been accelerated as of late by artificially low rates during Covid that are creating a lockdown effect in existing homes for sale. Recent inventory has been on the rise in 2024, but we are still seeing inventory levels that are 50% to 60% of pre-covid levels and we have a long way to go to get to a healthy inventory number.

City Highlights

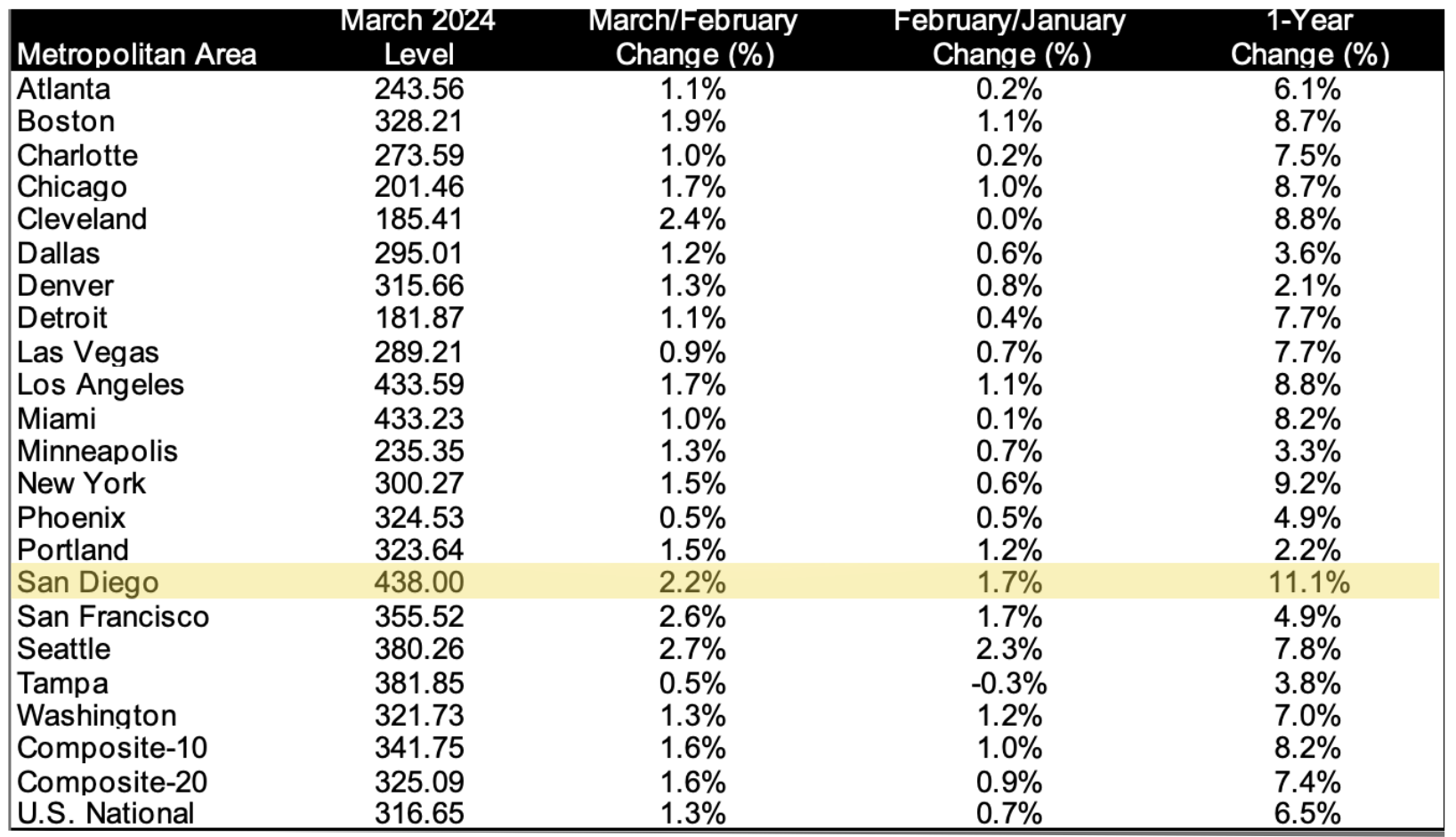

When we zoom in on specific metro areas, the 10-City Composite increased by 8.2%, slightly up from the previous month’s 8.1%. The 20-City Composite also showed a minor uptick, posting a 7.4% year-over-year increase compared to 7.3% in February. But the star of the show? San Diego, which dazzled with an 11.1% annual gain. San Diego, prices were up 2.2% in March of 2024 after a strong 1.7% in February and over 11% in the past year to lead the nation. Following closely were New York and Cleveland, with increases of 9.2% and 8.8%, respectively. The 10-city index includes includes some of the better-performing metro areas such as New York and Chicago, which have seen relatively stronger housing markets since mid-2022, as the migration back to cities and offices continues post Covid . On the other hand, the 20-city index features some cities that have been resetting after booming during the Covid years which saw excessive gains in home prices.

While all cities measured reported increases in annual prices, some saw much higher jumps than others (see national and 20 cities tracked by Core Logic below)

Monthly Trends

On a month-over-month basis, the U.S. National Index, the 20-City Composite, and the 10-City Composite continued their upward trajectory. The National Index saw a 1.3% increase, while both the 10-City and 20-City Composites rose by 1.6%. After seasonal adjustments, these gains were slightly moderated but still positive, reflecting a healthy market.

Market Analysis

The National Index alone has reached new highs in six of the last 12 months. With urban markets like San Diego, New York, Seattle, Boston, San Francisco and Los Angeles showing particularly strong demand, particularly in recent months.

Implications for Investors

So, what does all this mean for you, our esteemed investors? The continued rise in home prices suggests that real estate remains a lucrative investment. Urban markets, in particular, are experiencing robust growth, making them attractive targets for investment. However, as always, it’s crucial to conduct thorough market analysis and consider regional trends when making investment decisions. Pay close attention to inventory levels and interest rates as they hold the key to future home price gains or losses, and inventory has been increasing as of late. Coupled with fact that the expected interest rate decreases are getting pushed further into the horizon, there are some potential deflationary forces at work.

Why Choose Lantzman Lending?

At Lantzman Lending, we understand the dynamics of the real estate market and are here to help you navigate through these trends. Our expertise in hard money loans provides you with the flexibility and speed you need to capitalize on market opportunities. Whether you’re looking to invest in a high-growth urban area or diversify your portfolio, we’ve got the tools and knowledge to support your financial goals.

Final Thoughts

The March 2024 Case-Shiller Index reaffirms the strength of the housing market and offers promising opportunities for investors. As always, staying informed and partnering with experienced lenders like Lantzman Lending can make all the difference in maximizing your returns.

Stay tuned for more market insights and investment tips. And remember, in the ever-evolving world of real estate, knowledge is power!

For more detailed information and personalized advice, visit our website at [Lantzman Lending](https://www.lantzmanlending.com). Happy investing!

About the Case Schiller Index:

The S&P CoreLogic Case-Shiller 10-City Composite Home Price Index is a value-weighted

average of the 10 original metro area indices. The S&P CoreLogic Case-Shiller 20-City Composite

Home Price Index is a value-weighted average of the 20 metro area indices. The indices have a base

value of 100 in January 2000; thus, for example, a current index value of 150 translates to a 50%

appreciation rate since January 2000 for a typical home located within the subject market.